Section 179 Tax Savings on Ford Vehicles in Hanover, MA

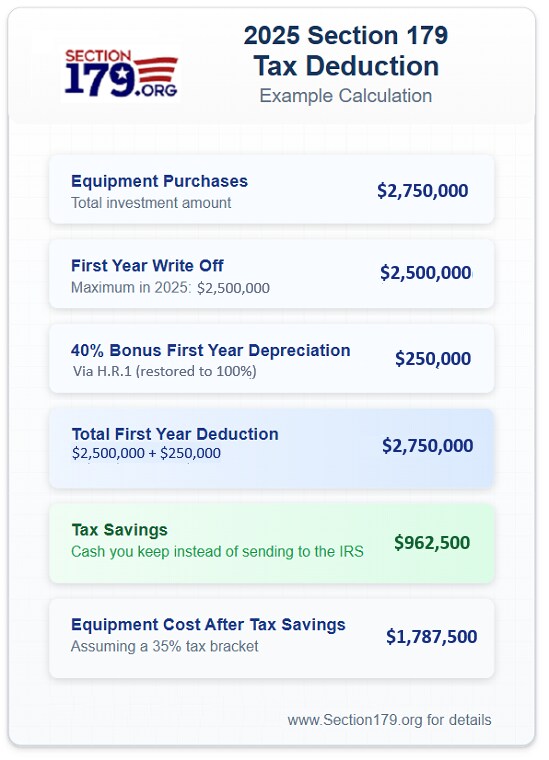

For many business owners, a dependable vehicle isn't just a convenience-it's a key part of the job. Thanks to Section 179 of the IRS tax code, businesses can write off the full purchase price of qualifying new or used Ford vehicles when they're placed into service during the same tax year. Rather than spreading depreciation over time, this incentive allows you to take the entire deduction up front, which can help improve cash flow and support continued growth.